How to Save Money On Fall Fashion Must-Haves

Now that the weather is changing, the shorts are being put away and the pants and cozy items are coming out. You may be looking at your fall clothing and thinking- blah. Right? I definitely need a few new fall pieces to help my wardrobe out. There are some great ways to save money on fall fashion must-haves of 2018.

Now that the weather is changing, the shorts are being put away and the pants and cozy items are coming out. You may be looking at your fall clothing and thinking- blah. Right? I definitely need a few new fall pieces to help my wardrobe out. There are some great ways to save money on fall fashion must-haves of 2018.

- Compare prices. If you have a specific item you are looking for, then be sure to compare prices from a few different stores. If you need a fleece jacket, then don’t pounce on the first deal you see. Check out a few more stores and see what the price is at. You may be surprised to find a cheaper one somewhere else.

- Use Coupons. Be sure to check the websites of all stores that you are shopping- even if you are shopping in-stores. There are usually always coupons or codes that you can use to lower the price. You can even check out their social media sites for promotions.

- Buy Secondhand. If you don’t mind that your clothes are gently used, then you can save a TON of money if you shop a secondhand store. You can find popular name brands for half the cost. Shop your local consignment shops or even online. There are also Facebook pages that are local garage sale pages that sell clothing.

- Shop Boutiques. If you love new items and variety, then you’ll want to check out boutiques. Jane is one of our favorite and they have really good prices on a ton of items.

- Wait to shop. If you notice your items you need are not on sale, then wait. Chances are in the next few weeks they will be on sale. Black Friday is around the corner and you will start seeing some crazy good deals. Be a little patient and you’ll start seeing some great prices on every fall fashion item you will want.

Amazon Will Start Selling LIVE 7 Foot Christmas Trees This Year!

Amazon is always looking for a way to add more benefits and lets be honest, make things easier for us! This holiday season they’re upping their game and will start selling LIVE 7 Foot Christmas Trees! This will include Douglas firs and Norfolk pines (the 2 most popular varieties) that will be bound and shipped right to your door.

Amazon is always looking for a way to add more benefits and lets be honest, make things easier for us! This holiday season they’re upping their game and will start selling LIVE 7 Foot Christmas Trees! This will include Douglas firs and Norfolk pines (the 2 most popular varieties) that will be bound and shipped right to your door.

Amazon has said they’ll be sent within 10 days of being cut down and should survive the shipping. But it gets better because they’ll also have wreaths and garlands you can order. It looks like everything will be on sale in November with some qualifying for free shipping with your Prime Membership as well as pre-orders.

So are they going to ask outrageous prices for these trees? Well it looks like their 7 foot Fraser fir from a North Carolina farm will be around $115 with wreath starting at $50. So will you be buying one of these live trees from Amazon this year? Or do you still plan to keep the tradition and pick out your own tree to haul home for Christmas.

5 Tips for Helping Your Child Learn About Money Management

Do you have children? Do you want you your kids to not have to worry about money as adults? Of course, you don’t. None of us want our children to live the paycheck to paycheck cycle that so many people struggle with every day.

If you want to give your kids a jump start on learning how to manage their money early here are 5 tips for helping your child learn about money management:

- Give them an allowance. How can your child learn how to manage money if they don’t have any? I know that not everyone agrees with this, but many people believe that it’s good to tie allowance into extra chores or other work that they do so they can learn what it takes to earn money as an adult instead of just giving them the money.

- Open a bank account for them. Banking is a huge part of the financial life of adults, it helps if kids can get an early start on this. This is also a great way to show them how their money can earn interest while in the bank.

- Allow them to spend. I always hate when I see parents who make their children save every penny that they have. Once these kids become adults and they have full control of their money, they are going to want to spend it because they’ve never had the opportunity before. This often leads to irresponsible spend days. This is why it’s good to allow them to spend a portion of their money while saving a portion of it and giving as well

- Lead by example. If you are irresponsible with your money, if you are bad at budgeting, if you are living the pay check to pay check cycle it’s going to be hard for your kids to do anything different because that is what that they see and that is what they know. This is a great opportunity to improve your financial life as well as theirs.

- Include them. When you or you and your partner sit down to discuss your budget or pay bills, have the kids sit down with you. It’s important for children to not go into adulthood blindsided by the reality of financial responsibility. They need to understand what will be expected of them as adults. No, I don’t mean burden them with the stress of your finances, but it is important to let them know these things.

5 Ways to Save Money as a Student

Are you a student? Or, do you have a child or family member that is a student? Well congratulations to all of the above, because being a student of higher education is something to take pride in and something that can take you further in life. It is, however, expensive to be a student sometimes. If you are looking for tips on saving money as a student for yourself or for someone else, here are 5 ways to save money as a student that you can implement now.

- Sign up for Amazon Prime Student. If you already pay for an Amazon Prime membership, you might consider switching it out to an Amazon Prime Student membership. You get 6 months free, you get it at half price AND you currently get $10 off of your first order!

- Rent your textbooks. Textbooks are a massive expense when you are in school. Check out your school library, or textbook rental sites to try and rent your books instead of paying hundreds of dollars for them.

- Apply for grants/scholarships. You will be quite surprised by how many grants and/or scholarships are out there and available for all ages/races/classes of people. This is FREE money, my friends!

- Walk. This is especially true if you live on campus or in a metropolitan area. Cars are expensive. Between gas, insurance, and upkeep, you can easily be into hundreds of dollars each month and this isn’t even including a car payment.

- Shop at places that offer student discounts. There are a large number of retailers that offer discounts to students, so be sure to look for these places before you do your shopping. Every little discount helps.

Are you a student? What ways have you found to save money?

5 Reasons you are Struggling to Save Money

Many of us struggle to save money at some point in our life, some of us struggle our whole lives with this. We are here now though and trying to fix it, no reason to beat yourself up. The trick is, to change the cycle now and put yourself in a different position. If you are busy trying to figure out why you are struggling to save money, here are 5 reasons why it may be happening.

- Low Willpower. We have all struggled with willpower to some degree. Be it a diet, or one too many Netflix marathons, or, yes, spending too much money.

- No written budget. A written or computer or app budget will make a massive, massive difference in your ability to save money. Knowing exactly where your money is going is key to being able to control your spending.

- Present bias. Present bias is described as placing the importance of an immediate reward over a future reward. For example, imagine that you have found with an unexpected $5,000 that can be used toward a down payment on a home or as a healthy deposit in your savings for the future, but you choose to spend it on a vacation because that sounds like more fun right now. Sound familiar?

- Keeping up with the Jones’. I get it. It’s hard to watch all of those around you get nice things while you are working your tail off still driving the same old car. I understand that it is frustrating. Just remember though, that all of those fancy new things cost money. Money that can serve you better being saved for your future. What would you rather have? A nice car with a huge car payment for the next 5 years? Or would you rather use that money to pay off your mortgage 5 years (or more) sooner?

- Not enough income. Okay, this one isn’t exactly true, because you can almost always save money, however, it is easier to save it if you aren’t stretched thin with your income. Consider taking up a second job or starting a new side hustle. This will help you pay off any debts that you have and get a jump start your savings.

Ham and Potato Corn Chowder Recipe

Can you feel the change in the air? I sure can and It’s getting chilly. Now that it’s officially Fall, I love making these comfort soups. They warm me from inside and out. This recipe comes from the closetcooking.com and it’s fabulous. It’s one that the whole family will enjoy.

Can you feel the change in the air? I sure can and It’s getting chilly. Now that it’s officially Fall, I love making these comfort soups. They warm me from inside and out. This recipe comes from the closetcooking.com and it’s fabulous. It’s one that the whole family will enjoy.

Ingredients:

- 3 tablespoons oil or butter

- 1 onion, diced

- 2 carrots, diced

- 2 stalks celery, diced

- 2 cloves garlic, chopped

- 1 teaspoon thyme, chopped

- 1/4 cup flour (or rice flour for gluten free)

- 2 cups ham broth or chicken broth

- 2 cups milk

- 1 1/2 pounds potatoes, diced small and optionally peeled

- 8 ounces ham, diced

- 1 cup corn

- salt and pepper to taste

Directions

- Heat the oil in a large sauce pan over medium-high heat, add the onions, carrots and celery and cook until tender, about 8-10 minutes.

- Mix in the garlic, thyme and flour and cook until the flour is lightly browned, about 2-3 minutes.

- Slowly stir in the broth, deglazing the pan as you go, add the milk and potatoes, bring to a boil, reduce the heat and simmer until the potatoes are tender, about 10-12 minutes.

- Add the ham and corn, cook until heated and season with salt and pepper.

7 Things that Cost Less in the Fall

Did you know that most of the things you buy go through changes in price cycles? It’s true. We have already discussed some of the best and worst things to buy during the month of September, but did you know that there are quite a few things that simply cost less during the fall season? Yep. Now that I have your attention, let’s talk about what those things are.

Here are 7 things that cost less in the fall that you should head out and shop for now to save:

- New cars. Weird, but true. New cars do cost less in the fall. Why? Well, this is because new models are getting ready to arrive at dealerships and they need to make room!

- Appliances. Appliances are going to cost less right now because new appliance models tend to hit the stores near the end of October to the early part of November.

- Bicycles. New models have recently come out and stores are looking to get rid of their stock. You will find bikes for as much as 30% off buying last year’s model.

- Houses. I have the Zillow App on my phone because of my recent house search and I’m not exaggerating when I tell you that I get at least 10 notifications each day about prices dropping on homes. That’s because Summer is the hot season for home buying and realtors recognize that. To keep the market moving, they will start dropping prices in the fall.

- Lawnmowers. The nice weather is quickly on its way out, and retailers know that people do not want to focus on yard work when it’s rainy and/or cold outside. That’s why now is the best time to buy a new lawn mower because retailers do not want to store them throughout the winter.

- BBQs and Outdoor Grills. Again, Summer is over. Retailers want to clear out summertime stock, not store it for the months ahead.

- Cookware. The holidays are just around the corner and for many that means it’s time to get your bake on, which also means that all of those pre-holiday sales will start to happen and we can score seriously deep discounts on cookware.

6 Cheap Tips for Throwing a Hit Holiday Party!

Are you planning to throw a party or two this holiday season? In this reference, I am talking about any holiday from Halloween to New Year! I freaking love the time between October and December and all of the reasons we have to celebrate, don’t you?

I am, however, a cheapskate and I don’t like to spend a ton of money to celebrate so I like to do what I can do keep my celebrating budget-friendly. If you feel the same as me, here are 6 cheap tips for throwing a hit holiday party:

- Make it a potluck – Truth be told, most people like to contribute to a party that they are attending. Make your party a potluck and take some stress off of preparations. You don’t have to do it all.

- Go easy on the decor – Extreme decor is unneeded when it comes to parties. Sure you want to dress it up a bit, but I promise you that you do not need to go overboard with it.

- Shop at the dollar store. The dollar store has great decor and other party essentials such as paper plates, plastic cups, etc. and they are so much cheaper than at other stores.

- Use last year’s stuff. Maybe you don’t need to buy anything. Don’t be afraid to go through your holiday decor and supplies you have buried in storage. You might as well save some money by reusing what you already have.

- Don’t serve booze. Alcohol is expensive. Try having an alcohol-free party and see how much you can save.

- Serve only snacks. There is nothing saying that you have to serve a meal at your party. Just keep it stocked with snacks and you will have some happy guests!

What are your best cheap party tricks? I’m excited to hear about them because I am planning to have a couple of holiday parties this year!

6 Benefits of Amazon Prime

Have you signed up for Amazon Prime yet? I know that many of you may think that Amazon Prime is a waste of money and as a budget shopper, I understand that completely. $119 is a lot of money to spend each year and unless you don’t see the benefits of what that $119 can do for you, I wouldn’t want to do it either. However that $119 is actually a pretty great deal and here’s why:

6 benefits of Amazon Prime:

- Special Discounts. You can almost always find special deals that are exclusive to Prime members. Be sure and keep an eye out here at our website, and stalk your Amazon account to find special deals on all kinds of stuff.

- Music Streaming. Do you love to listen to music? Amazon Prime members get access to thousands of songs without having to pay for a music streaming service. That being said, Amazon does have a music streaming service that costs money, but offers even more options, however, you don’t have to sign up for it in order to enjoy your favorite music.

- Movie Streaming. Are you a movie buff? Amazon Instant Video has thousands of videos, tv shows and exclusive programs available for Prime members to stream.

- Free 2 Day Shipping. One of my favorite things about Amazon is the free shipping option. I actually buy a lot of my household stuff on Amazon (I have a toddler and barring any rock-bottom coupon deals, I exclusively shop at Amazon for diapers).

- Great deals. I know I already mentioned the good deals that Prime members get, but in general, you can score some great deals on Amazon! Plus, shopping Amazon saves on gas and other expenses in going to the store.

- Access to free books. Prime members can also get access to Kindle books for free! Who doesn’t like a great, free read?

Do you shop at Amazon? What are your favorite benefits of being a Prime member? If you aren’t a Prime member, why not?

If you are ready to give it a shot, you can get a 30-day free trial of Amazon Prime here.

Start Earning Money Now for Christmas!

Are you wanting a little bit of help building up some cash for your Christmas budget? As of the date of this posting, Christmas is only 94 days away. That’s ok though! Hope is not lost! You still have time to start building a healthy Christmas fund account so that you don’t have to dig yourself into debt just buying gifts.

Start earning money now for Christmas so that you can keep from going into debt:

- Get a second job – Lots of companies are hiring seasonal workers right now. Jump on board to earn some money to spend this Christmas! You will likely earn far more money than you need for Christmas, so this is also a good chance to add to your savings. The good news is that these jobs are temporary so the time commitment is only for a short time, but it is well worth it to avoid debt.

- Sell your stuff – Go through your stuff now and start putting it up for sale. Use sites such as OfferUp, LetGo, Craigslist and Facebook Marketplace. You will be surprised by how much money you might find lurking in your closets and garage. I know people who have cleared out their extra storage to end up with an extra money in excess of $1000. I know others who have made only a couple hundred, but either way, it’s extra money!

- Swagbucks. Swagbucks gives you lots of opportunities to earn gift cards that can be spent at stores that you are planning to shop at anyway.

- Sell plasma. There are a lot of people who sell plasma for extra money. Have you ever done this? I have never done it personally, but I have done some research and found that you can make up to $50 per donation, plus I think that many plasma centers offer promotional bonuses for your first donations.

What do you do to make extra money to spend over the holidays?

Up to 20% off at Living Social!

It’s the first day of Fall folks, it’s time to have some Fall fun! Head on over to Living Social and find something great to do for a discount when you use this new promo code! Through tomorrow, Living Social is offering 20% off Your Purchase! Just use promo code FALL20 at checkout.

There are so many deals to choose from!

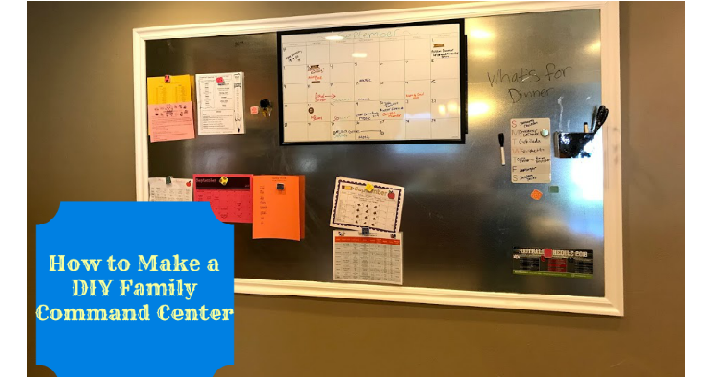

How to Make a DIY Family Command Center on a Budget

Staying organized can be quite the task when you have a family. Kids come home with papers, invitations, permission slips and more. I get so frustrated with papers! I’ve decided we need one central location where we can see these important papers and be organized all at once. These family command centers are awesome. You can have your papers, calendars, meal planning and more all in one place and in view. If you were to buy these out right you would pay a TON, so save some money and make your own. Here’s how we made ours:

Staying organized can be quite the task when you have a family. Kids come home with papers, invitations, permission slips and more. I get so frustrated with papers! I’ve decided we need one central location where we can see these important papers and be organized all at once. These family command centers are awesome. You can have your papers, calendars, meal planning and more all in one place and in view. If you were to buy these out right you would pay a TON, so save some money and make your own. Here’s how we made ours:

Materials:

Galvanized Steel Metal Sheet- cut to the dimensions you want.

Moulding/Trim

Picture Hanging System

Construction Adhesive

Paint

Accessories: Calendars, Magnets, Meal Schedules, Markers.

Directions:

- Outline with painters tape where you want your board. Measure and order your metal sheet. We went through Metal Supermarkets.

- Measure lengths for moulding and purchase that at a home improvement store.

- Cut corners of moulding to make a picture frame. You could do this yourself or ask Home Depot or Lowe’s to do it for you.

- Paint your moulding to the color you want- we just did a normal white. Then let dry completely.

- Attach moulding to metal sheet with the constructive adhesive.

- Use clamps or heavy objects to weigh down the moulding so it sticks completely. Follow directions of the adhesive-may require 48 hours to dry.

- Follow directions of the picture hanging system and attach on the back of your sheet metal board.

- Hang board on the wall and add nails into the moulding at the bottom if you want. We added 2 at the bottom to make it completely flat against the wall. Then you can putty and paint over the nail holes.

- Add accessories and enjoy!

**Tips- Be super careful with the sheet metal. It is really sharp, so you’ll want to wear gloves and keep kids away. Be sure to completely cover the metal with the moulding so no sharp edges are showing.

Happy National Preparedness Month!

Did you guys realize it’s National Preparedness Month? What better time of the year especially where we live. We’ve had many evacuations due to fires and it’s really got me thinking about our own home, what we’d take and leave behind and how quickly could we get out.

We’ve talked about 72 hour kits before and if you missed it you can check it out here. But what about documents you need and identification? Not only are you going to want these printed and in some sort of binder but it’s a good idea to put copies of all your documents onto a flash drive. We have two flash drives, one in our fire proof safe and another at a relatives house just in case.

This is something simple to pull together but in an emergency you’ll be so grateful all this information is stored together in an easy grab and go spot. Here’s some important documents to have in your binder:

- Identification papers (passports, copies of driver’s license, social security cards, birth certificates and even a family picture)

- Insurance papers (contact information as well as policy numbers. I also highly recommend you have documented or taken pictures/video of every room in your home)

- Personal documents (marriage certificates, family history records, family keepsakes)

- Other documents (titles to your cars, home owners paperwork, pet documents)

- Medical documents (allergies, prescriptions, immunizations and medical conditions)

- Contact Information (family/friends number that live out of state, immediate family and their work contact information)

You don’t know when that time will arise that you’ll need to grab your important stuff and leave the house, unknown if you’ll be able to return and what will be lift. Please take some time this month to get prepared.

The Worst Things to Buy in September

The other day we talked about the best things to buy in September, so I thought I would expand on that and we could talk about the things that you might want to avoid buying this month. Again, I know we are pretty far into the month, but it is still helpful to know!

I am thinking that I will start making this a monthly feature so that we are all on the same page as to what we should be shopping for or looking to avoid during each month. What do you think?

Okay, back to the matter at hand. Here are the worst items to buy in September:

- TVs – Televisions and other electronics are at their best prices during the holidays. Wait just a few more months to buy a new one for your household.

- Winter clothes – Summer clothes are what’s on clearance right now, as the winter clothes are just now hitting the racks, wait a bit to buy winter clothes or you will be paying full price.

- Kids toys – Okay, folks, you know the drill. Toys drop to ridiculously low prices if you wait until holiday sales, or if you can, until just after the holidays.

- New phones – New phone models are just now coming out. Unless you are ok with buying last year’s models (the best idea actually), you should avoid buying right now. It’ll be much cheaper if you wait even just a few months.

- Appliances – Unless you are able to score a sweet Labor Day sale, it’s best to wait on appliances until just around the holidays when prices go down.

What has been your best ever September purchase? What do you wish you would have waited to buy?

The Debt Snowball Explained

Credit cards and loans have been around for a long time and they are, for many of us, a normal way of life. For some, it works great. For others though, the credit card and loan debt really starts to drown us down. Many of us have debt to some degree and a lot of us are also working hard to get it taken care of.

There is a lot of chatter out there on the best ways to pay off debt. Some people strongly feel that the avalanche is the only way to go, but I have been hearing a lot lately on how successful paying off debt using the snowball method can be.

What is the debt snowball, you ask? Well, here’s a quick little rundown of what it is exactly:

The debt snowball is a debt reduction strategy, wherein the debtor pays off their smallest debt first and then rolls the payment for the smaller debt into the payment on the next largest one and so on. The point of this debt payoff method is to keep you motivated and focused while paying down your debt.

Here is a breakdown of the debt snowball steps:

- List all of your debts from smallest to largest. This is their balance, not the interest rate.

- Decide how much extra you have to apply to your debt.

- Add this amount to the minimum payment on the smallest bill, while paying just the minimums on the other debts.

- Once you get a debt paid off, use the minimum payment that was going to that and apply it to the next largest debt.

- Repeat this process until you are debt free.

Are you working on a debt repayment system? How is it going for you? Or, have you been successful at paying down debt before? What process did you use? Is there any adjustments that you would make if you were to do it again?